Secure loans to existing collateral such as a household, an automobile, or high priced jewellery. Most lenders see secured loans as significantly less risky than unsecured loans and tend to be more willing to present increased loan amounts with far more favorable fees.

And unlike a normal charge, cash advances get started accruing interest as soon as you go ahead and take advance. To put it simply, you’ll shell out fascination Even though you pay your Monthly bill in total by your due day.

Accessibility: Lenders are rated bigger if their particular loans can be obtained to more people and involve much less conditions. This will likely consist of lower credit requirements, wider geographic availability, more rapidly funding and a lot easier plus more clear prequalification and application procedures.

Late payment rate—Lenders can charge a fee for having to pay also late. Stay away from this by simply shelling out all dues by the due date. It will help to Get hold of lenders beforehand if a payment can't be designed on the owing date, as some are prepared to lengthen deadlines. This price may be flat or assessed like a share on the payment, based on the lender.

This details is applied to prevent fraud. Lenders will NEVER Make contact with your employer to disclose your loan inquiry. In case you are on Added benefits, enter your

LightStream doesn’t specify its minimum amount credit rating score prerequisites, however you should have very good to great credit rating. Some of its other general eligibility tips consist of check here possessing:

Mirenda agreed during the loan purposes that his loan proceeds would be utilized "solely as Performing cash to relieve economic personal injury brought on by the pandemic," the U.

The rate generally released by banking companies for conserving accounts, income market accounts, and CDs may be the yearly share yield, or APY. It is crucial to comprehend the difference between APR and APY. Borrowers seeking loans can estimate the actual desire paid out to lenders primarily based on their marketed costs by utilizing the Interest Calculator. To learn more about or to perform calculations involving APR, you should stop by the APR Calculator.

If you need funds speedy but have negative credit score or no credit rating history, you might need to apply for a fast individual loan by using a co-signer or co-borrower.

However, your co-signer or co-borrower will be equally to blame for spending back again the loan, which suggests you will need to be on the same web site with the co-applicant to ensure the loan is paid off.

What’s extra, some on the web lenders tailor loans to applicants with scores below 670 and from time to time scores as low as 560. These are generally also referred to as reasonable credit history private loans and lousy credit personal loans, respectively.

You conform to a settlement day once you go ahead and take advance. We don’t cost interest or late costs, so settling up received’t have surprises.

Certainly one of the lowest minimum amount credit history prerequisites all over Don’t constantly need a credit rating to qualify Typically isn't going to demand you to file paperwork Drawbacks

So that you can accomplish that, be sure to Adhere to the putting up regulations within our web site's Terms of Service. We have summarized a number of Individuals important guidelines below. To put it simply, hold it civil.

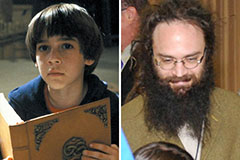

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now!